We offer you a list of resources and useful elements to start and create your company.

Law creates and grows

We offer you a abstract of Law 18/22, of September 28, on the creation and growth of companies.

business plan

- Manual for the development of the business plan. Basic guide for the preparation of the business plan that the Madrid City Council makes available to entrepreneurs. It is complemented with the Simulator.

- Business plan simulator. Complementary tool to the Business Plan Manual for you to enter your project data and obtain the final document in pdf format.

- Tool to prepare the business plan. Tool developed by the DGIPYME that helps to develop the online business plan. Requires registration.

Taxation

- Taxation and accounting for businessmen and professionals, individuals physical. This document prepared by the Tax Agency details all the tax obligations that businessmen and professionals, natural persons, have to comply with.

- Guide to the new Accounting Plan for SMEs. Guide prepared by the Ministry of Industry, Tourism and Commerce, for the application of the PGC PYME, which tries to simplify and systematize the information, incorporating examples and exercises, on the basis of the Regulations approved in Royal Decree 151. Modified and updated BOE no. January 26, 30, 2021

- Taxpayer Calendar 2023. Prepared by the Tax Agency, aimed at reminding compliance with the main state tax obligations.

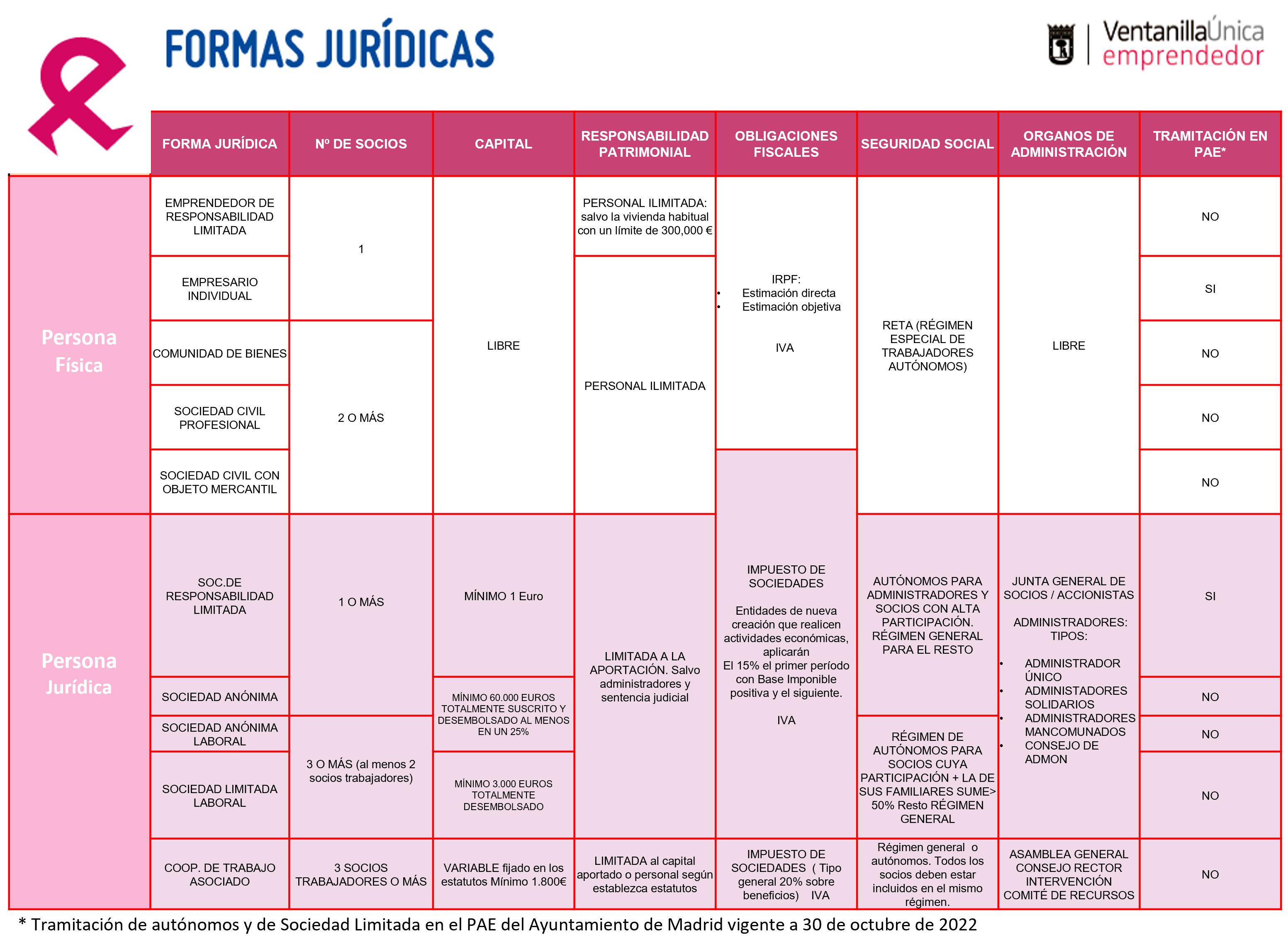

Creation / dissolution of companies

- Choice of legal form. Help tool when choosing the legal form for the company.

- Creation of companies. Business creation processes and flowcharts according to the chosen legal form (DGIPYME).

- Limited companies I – Incorporation procedures. Informative triptych on the necessary procedures for the creation of a Limited Company.

- Limited companies II – Beginning of activity. Informative brochure that exposes the most common procedures for the start-up and development of the activity.

- Individual entrepreneur – Procedures to start activity. Informative brochure that details the mandatory procedures necessary to register as self-employed.

- Telematic incorporation of companies. Informs about the electronic processing of SL and the documents necessary to carry it out.

- Capitalization of unemployment. It is an aid that allows you to convert the amount of the unemployment benefit pending receipt into a single payment.

- Company: termination of the company. Manual published by the DGIPYME.

- Company: extinction of the company. Manual published by the DGIPYME.

- termination of self-employment. Manual published by the DGIPYME.

Other links of interest

- Tax agency

- Chamber of Madrid

- Entrepreneurs Portal – Madrid Community

- Spanish office of the patents and brand

- European SME Portal